One of EBAN’s main activities is to do research on the early stage and business angel markets. Annually, EBAN publishes 3 different Compendia: The Statistics Compendium, which takes the pulse of the European early stage market in terms of investment activity, the Compendium of Co-Investment Funds and the Compendium of Fiscal Incentives, which map the tax schemes and investment funds available for angel investors throughout Europe. On top of this, EBAN works together with its members and partners such as the EU, OECD and AFME, on other research related publications and position papers.

Check out out latest annual publications:

EBAN publications archive:

EBAN 25th Anniversary History Book

25 Years of EBAN Since its establishment in 1999, it has been our privilege and honour to drive the growth of the early-stage investment and entrepreneurial ecosystem across Europe and beyond. Over the past 25 years, through numerous programmes, initiatives, and events, EBAN has facilitated the creation of a more integrated innovation value chain, enabling smart capital, corporations, governments, and innovators to collaborate more effectively and synergistically. Through its Network, Events, Communities, EBAN Academy, Research and Advocacy work, the association has positioned itself as a leader in connecting angel ecosystems across borders, setting standards and best practices in the market, fostering knowledge-sharing among diverse stakeholders and representing the interests of the asset class. Now heading into its 26th year, We want to celebrate this important milestone and many of the achievements made to date through this publication. Download the EBAN 25 Years History Book here

Building a Vibrant Business Angel Ecosystem in Europe

Building a Vibrant Business Angel Ecosystem in Europe Recommendations for EU and National Policy Makers This Policy Recommendation Paper addresses key issues facing the EU’s startup ecosystem, particularly the lack of funding and regulatory barriers that push many startups to relocate during the scale-up phase. Despite Europe’s innovation potential, early-stage investments are limited. The paper calls for streamlined regulations, cross-border funding incentives, and stronger government support to boost business angel investments and improve liquidity for startups. Aligned with Mario Draghi’s competitiveness strategy, it offers actionable recommendations to ensure the EU remains a global leader in innovation and technology. We identify 7 key areas that need to be addressed by the EU: To see more and learn about the actions we recommend to fix these issues, download the full paper below! Fill the form below to subscribe and download the paper Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download

EBAN Annual Statistics Compendium for 2023

EBAN presents the EBAN Annual Statistics Compendium for 2023, Europe’s most extensive annual research on the activity of business angels and business angel networks. The Compendium offers comprehensive insight into the overall early-stage market, shedding light on the operational dynamics of business angel networks and providing valuable insights into their investment attitudes. Drawing from a wealth of sources, including European business angel networks, Federations of BANs, and data from prominent platforms such as Dealroom.co, Crunchbase, PitchBook, and the European Commission, the report offers a nuanced perspective on the entrepreneurial landscape. This report covers 38 countries on the European continent, the figures presented in the report, while not representative of the entire European market, provide valuable insights into the trends and developments shaping the early-stage investment landscape. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download

EBAN Annual Statistics Compendium for 2022

EBAN presents the EBAN Annual Statistics Compendium for 2022, Europe’s most extensive annual research on the activity of business angels and business angel networks. The Compendium offers comprehensive insight into the overall early-stage market, shedding light on the operational dynamics of business angel networks and providing valuable insights into their investment attitudes. Drawing from a wealth of sources, including European business angel networks, Federations of BANs, and data from prominent platforms such as Dealroom.co, Crunchbase, PitchBook, and the European Commission, the report offers a nuanced perspective on the entrepreneurial landscape. This report covers 38 countries on the European continent, the figures presented in the report, while not representative of the entire European market, provide valuable insights into the trends and developments shaping the early-stage investment landscape. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+Statistics+Infographic&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2023%252F12%252FInfographic-Updated-post-summit-27.11.23-1.png%7C%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+EBAN%27s+Statistics+Compendium+2022&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fdrive.google.com%252Ffile%252Fd%252F1Ej66IXC5lUNjyaIqyKvfQaBRs_2ukWSv%252Fview%253Fusp%253Dsharing%7Ctitle%3ADownload%2520EBAN%27s%2520Statistics%2520Compendium%25202022%7Ctarget%3A%2520_blank%7C }}

EBAN Data Report: Business Angel Networks and Angel Federations in Europe 2023

This report by EBAN provides a list of all Business Angel Networks and Federations currently active in Europe. It has been compiled through a combination of online resources and data providers such as our partner Dealroom, as well as Pitchbook, Gust, National Business Angel Network listings, Social Media Platforms, reports by EBAN Members, and more. Currently, there are 358 organizations identified by EBAN as active Business Angel Networks or federations spread across 37 countries. A full breakdown of organizations per country can be found in the report. The purpose of this report is to provide a better overview of the Business Angel Networks and Federations ecosystem in Europe. Read or download the report here: v

EBAN Data – Agrifood sector in Europe

In this EBAN Data Monthly Report, we present an overview of the agrifood entrepreneurial and investment ecosystem in Europe (including Türkiye), with a focus on the investments in Agrifood companies in between 2020 and 2022, and the suggestions by EBAN to enhance private investment in Agrifood sector in Europe. In this report, we adopt FAO’s definition of “Agrifood” which covers “from agriculture production through to food consumption”. The analysis is supported by the data gathered through our partner Dealroom.co, a platform that gathers all publicly disclosed information on funding rounds made in Europe and beyond as well as through research on the literature, and the support of EBAN members who have contributed individually through interviews and as a group during the co-creation workshops. In Europe, private investment has been growing in the agrifood sector. Looking at the European VC rounds, investments in food startups increased 12 times between 2013 and 2020 and foodtech startup valuations increased 1.5 times between 2019 and 2020. Then, in only 1 year, between 2020 and 2021, investments in food startups have more than doubled . The effect of the COVID-19 pandemic is highly related to this increase. Focusing on the Business Angels investment in Europe, a significant growth can be seen in investment in food between 2019 and 2021, but the sector remains limited compared to the others, such as fintech and health. It is important to note that the agrifood investment and entrepreneurial ecosystem is developing at a different pace in different regions, even though it is central to the European economy.

EBAN Impact Investing Report 2021 – 2nd Edition

EBAN Impact Publishes its 2nd Annual Impact Investing Report – Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our 2nd edition of 2021 Impact Investing Report #EIIS2021. EBAN Impact is the home for all EBAN members interested in impact investing and social entrepreneurship. The Impact Investing Report provides information on the profile and background of impact investors, as well as the characteristics that define their investments. EBAN Impact’s Investing Report is based on a survey launched in April 2020 led by Juan Alvarez de Lara, board member of EBAN, chairman of EBAN Impact, and founder of Seed&Click, and sponsored by Dr. Lisa Hehenberger and Dr. Kai Hockerts, professors at ESADE Business School and Copenhagen Business School respectively.

Capital Markets Union Key Performance Indicators – Fifth Edition by AFME

AFME, EBAN, and 10 other organisations published the fifth edition of the “Capital Markets Union – Key Performance Indicators” report. Over the last five years, this report has tracked the progress of Europe’s capital markets against nine key performance indicators. The 5th CMU progress report finds that the EU as a whole is falling further behind other jurisdictions in terms of its global attractiveness as a place for businesses to access deep pools of capital and go public. While there have been some considerable policy achievements over the last five years, including the EU maintaining its global leadership on sustainable finance and improving its FinTech regulatory ecosystem, our report shows there are several obstacles hampering the progress of the CMU.

Statistics Compendium 2021 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium – Reporting on the Activity of Business Angels and Business Angel Networks in Europe Data on the investments made across the 38 different European countries measured in the report indicates that the visible angel investment market on the European continent has grown substantially from the 767 Million Euros invested in 2020, to a record 1,456 Million Euros invested in 2021 (+90% from the previous year). In 2021, angel investors were involved in over 5070 observed funding rounds, consisting in both initial investments and follow-on investments made in European based start-ups. Based on the reports provided by national federations, local angel networks, and national venture capital associations, there are approximately 39400 active business angel investors on the European continent who are part of a local investment network or association. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+Statistics+Infographic&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2022%252F10%252F2021-venngage-cropped.png%7C%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+EBAN%27s+Statistics+Compendium+2021&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2022%252F10%252FStatistics-Compendium-2021-FINAL-3.pdf%7Ctitle%3ADownload%2520EBAN%27s%2520Statistics%2520Compendium%25202021%7Ctarget%3A%2520_blank%7C }}

SpaceTech Across Europe, report 2022

In this report we present an overview of the investments in the SpaceTech companies done in Europe between 2017 and 2021, with a focus on the most recent years 2020-2021. The analysis presented below is supported by a list of 918 deals gathered through the EBAN Space community and our partner Dealroom.co, a platform that gathers all publicly disclosed information on funding rounds made in Europe and beyond. The deals were filtered by the following criteria: companies’ headquarters based in Europe; type of technology utilised by the company and type of industry. Even if more and more investment rounds are publicly announced, and public fundings such as grants are also disclosed, we are fully aware that information about many investments done are not publicly available. Therefore, these publicly undisclosed deals cannot be taken into account in reports such as this one. We are confident that the data presented in this report shows a valid overview of the SpaceTech sector and its trends although representing the visible investment market only and some undisclosed deals. This report presents an overview of the investment activity across the European continent, not intended for comparison purposes with other markets around the world. The SpaceTech sector includes projects and companies that adopt space technologies both for space and non-space applications. Given that, in this report we decided to add to the classic upstream/downstream classification an analysis by industry and thematic areas for the biennium 2020-2021. This allows to present the SpaceTech sector to non-space experts and investors in a broader and complete way. This categorization exemplifies the impact of space technologies outside the space industry. Looking at the trend across the years 2017-2021, we can observe a surge of the investments in the SpaceTech sector, reaching 3.7 billion euros in 2021. It is also clear from the data that the number of funded companies decreased over the years by approximately 50%. Ultimately, the total amount invested in SpaceTech per country has been considered and compared with the contribution (in percentage) of each country to the ESA budget for activities and programmes.

Statistics Compendium 2020 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium – Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce the publication of our Annual Statistics Compendium – Europe’s most extensive annual research on the activity of business angels and business angel networks. EBAN’s Statistics Compendium is based not only on the information provided by European business angel networks, Federations of BANs, individual business angels and but also based on data published in 35 other sources amongst which include: Dealroom.co, Crunchbase, PitchBook, the European Commission, National Venture Capital Associations, national and regional research studies on angel investment. Data on the investments made across the 37 different countries measured in the report indicates that the visible angel investment market on the European continent has declined from 804 Million Euros in 2019 to 767 Million Euros in 2020. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+EBAN%27s+Statistics+Compendium+2020&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2021%252F12%252FEBAN-Statistics-Compendium-2021-1.pdf%7Ctitle%3ADownload%2520EBAN%27s%2520Statistics%2520Compendium%25202021%7Ctarget%3A%2520_blank%7C }}

Capital Markets Union – Key Performance Indicators (Fourth Edition)

AFME Finance for Europe presents Capital Markets Union – Key Performance Indicators, the fourth edition in a series of annual reports which tracks the development of the European capital markets ecosystem. The report, which EBAN contributed to, assesses Europe’s progress in improving the depth of its capital markets against 8 key performance indicators, as well as providing an industry perspective on some of the enablers of European capital markets growth and ongoing barriers to integration and development.

EBAN Statistics Compendium 2019

EBAN Publishes its 2019 Statistics Compendium – Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN is pleased to present the new edition of the Annual Statistics Compendium, which reports on angel investment data related to 2019. The Compendium provides information on the visible angel market data gathered across 38 European countries. Compared to 2018, the European angel investment market grew by 9.77%, a record year for the industry. Angel investors represented the most important providers of risk capital, accounting for nearly 60% of the total early stage investment market. Fill the form below to subscribe and download the Statistics Compendium and infographic: Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+the+Statistics+Compendium+%28PDF%29&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F12%252FEBAN-Statistics-Compendium-2019.pdf%7Ctitle%3AStatistics%2520Compendium%25202019%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+the+Statistics+Compendium+Infographic+%28PNG%29&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F12%252Ff493e2c6-a480-476e-86dc-961774f2096f-2.png%7Ctitle%3AStatistics%2520Compendium%25202019%2520Infographic%7Ctarget%3A%2520_blank%7C }}

EBAN Data – Measuring Angel Market Data: 2020 Guidebook

EBAN Data Publishes its 2020 Guidebook on Measuring Angel Market Data – A Tool to Allow Comparison and Benchmarking between Investor Communities EBAN Data is delighted to announce the publication of our 2020 Guidebook on Measuring Angel Market Data, providing the best practices from our network for the collection of data points related to business angel investments. In particular, the Guidebook has the goal of standardizing across the European business angel network ecosystem the way investment data is collected and analysed, so to better allow comparison and benchmarking between investor communities across Europe. The guidebook contains questions and a glossary of terms created as the result of a harmonization process that was performed on the various surveys currently being used by EBAN Data Committee members. The survey is specifically created for individual angel investors, affiliated to a business angel network or to a national business angel association. It was established by the members of the EBAN Data Committee in collaboration with EBAN Members DanBAN, FiBAN, EstBAN, HBAN, and SICTIC. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+the+EBAN+Data+Guidebook+%28PDF%29&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F12%252FGuidebook-on-Measuring-Angel-Market-Data-EBAN-Data-2.pdf%7Ctitle%3AEBAN%2520Data%2520%25E2%2580%2593%2520Measuring%2520Angel%2520Market%2520Data%253A%25202020%2520Guidebook%7Ctarget%3A%2520_blank%7C }}

EBAN Impact Investing Report

EBAN Impact Publishes its First Impact Investing Report – Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our first Impact Investing Report #EIIS2020. EBAN Impact is the home for all EBAN members interested in impact investing and social entrepreneurship. The Impact Investing Report provides information on the profile and background of impact investors, as well as the characteristics that define their investments. EBAN Impact’s Investing Report is based on a survey launched in April 2020 led by Juan Alvarez de Lara, board member of EBAN, chairman of EBAN Impact, and founder of Seed&Click, and sponsored by Dr. Lisa Hehenberger and Dr. Kai Hockerts, professors at ESADE Business School and Copenhagen Business School respectively. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+the+EBAN+Impact+Investing+Report&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F12%252FEBANIMPACTINVESTING2020-REPORT-2.pdf%7C%7Ctarget%3A%2520_blank%7C }}

Capital Markets Union Key Performance Indicators (Third Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is entitled, ‘Capital Markets Union – Key Performance Indicators (Third Edition)‘, third publication that reviews developments in the CMU project and identifies what further work needs to be done. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+the+Report&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F11%252FAFME_CMU_KPIs2020_04-1-2.pdf%7C%7C%7C&el_class=subscribe-and-download }}

Statistics Compendium 2019 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium – Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce the publication of our Annual Statistics Compendium – Europe’s most extensive annual research on the activity of business angels and business angel networks. The Statistics Compendium provides information on the overall early stage market and on how business angel networks operate, as well as insight into their investment attitudes. EBAN’s Statistics Compendium is based not only on the information provided by European business angel networks (hereafter BANs), Federations of BANs, individual business angels and other validated early stage investors who responded to EBAN’s Survey, but also based on data published in 122 other sources which include: Dealroom.co, Zephyr database (Bureau van Dijk), Crunchbase, Startup Watch, European Commission National Venture Capital Associations, governmental BA co-investment funds and fiscal incentive reports, and national and regional research studies on angel investment. Compared to 2018, the European angel investment market grew by 9.77%, a record year for the industry. Angel investors represented the most important providers of risk capital, accounting for nearly 60% of the total early stage investment market. Fill the form below to subscribe and download the report Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+Statistics+Infographic&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Feban.img.musvc1.net%252Fstatic%252F90357%252Fdocumenti%252FConsoleDocuments%252FStatistics%2525202018%252520Infographic.pdf%7C%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+EBAN%27s+Statistics+Compendium+2019&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2020%252F12%252FEBAN-Statistics-Compendium-2019.pdf%7C%7Ctarget%3A%2520_blank%7C }}

Compendium of European Co-Investment Funds with Business Angels

The Co-Investment Compendium is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning about different forms of collaboration between business angels and public authorities. The publication covers 29 different countries and includes 107 case studies on different co-investment funds. It also features chapters on the importance of co-investment funds to support angel investing, as well as on best practices and FAQs for setting up co-investment funds. EBAN expresses its gratitude to all contributors who provided data and information for the publications. Fill the form below to subscribe and download the Statistics Compendium and infographic: Email* When you submit the form, check your inbox to confirm your subscription Name* Surname* Organization* Privacy* I´m authorizing EBAN (The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, located in Brussels, 1040 BE) to save and use my personal data according to the General Data Protection Regulation (GDPR). This information is used by EBAN exclusively for sending newsletters and other email campaigns about the latest developments in the global entrepreneurial, innovation, and early-stage ecosystem. Subscribe and Download {{ vc_btn:title=Download+2018+Coinvestment+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2019%252F11%252FCoinvestment-Compendium.pdf%7C%7Ctarget%3A%2520_blank%7C }}

2018 EBAN Compendium of Fiscal Incentives

Fiscal incentives have an important role in stimulating the activity of business angels and early stage equity investors in start-ups. They encourage private investors to diversify their portfolio towards unquoted (primarily equity) investments in high-growth, innovative companies. This can significantly increase the pool of private individuals ready to make an equity investment in a start-up. This year, EBAN partnered again with BOFIDI to develop the Compendium of Fiscal Incentives, which covers 34 countries. We would like to thank BOFIDI and its network of 19 partner organisations for working with EBAN to address the lack of knowledge about the fiscal situation in different European countries, one of the main barriers holding investors back from co-investing internationally. {{ vc_btn:title=Download+EBAN%27s+2018+Fiscal+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2019%252F11%252FFiscal-compendium.pdf%7C%7Ctarget%3A%2520_blank%7C }}

AFME Report on Capital Markets Union (Second Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is entitled, ‘Capital Markets Union – Key Performance Indicators (Second Edition)‘, second publication that reviews developments in the CMU project and identifies what further work needs to be done. {{ vc_btn:title=Download+the+Report&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.afme.eu%252FPortals%252F0%252FDispatchFeaturedImages%252FAFME%252520CMU%252520Key%252520Performance%252520Indicators%252520Report.pdf%7C%7Ctarget%3A%2520_blank%7C }}

Compendium of European Co-Investment Funds with Business Angels

This latest edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning, first of all, about different forms of collaboration between business angels and public authorities. It provides information on one of the most important incentives to stimulate and organise angel activity: angel investment funds and co-investment funds. In addition, it also aims to aid in discovering different forms of collaboration between business angels and other private players in the early-stage market. The compendium integrates a list of co-investment funds, angel funds, and some other relevant co-investment activities identified in Europe associated with detailed elaborations in the form of case studies about some of the abovementioned, including information as well on the expected market impact and challenges faced by these funds. EBAN is proud to announce that, this year, we have enriched our publication with two new chapters on the importance of co-investment funds to support angel investing as well as on best practices and FAQs for setting up co-investment funds. {{ vc_btn:title=Download+the+Co-Investment+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2018%252F12%252FCompendium-of-European-Co-Investment-Funds-with-Business-Angels.pdf%7C%7Ctarget%3A%2520_blank%7C }}

EBAN Activity Report June 2017 – June 2018

EBAN is pleased to present the latest edition of its annual Activity Report, detailing our activities and initiatives over the period of June 2017 – June 2018. The report includes updates on EBAN membership, research publications, EBAN Communities, EU projects, and partnerships, and more. Download the EBAN Activity Report June 2017 – June 2018 to learn more. {{ vc_btn:title=Download+the+EBAN+Activity+Report&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2018%252F11%252FEBAN-Activity-Report-June-2017-June-2018.pdf%7C%7Ctarget%3A%2520_blank%7C }}

AFME Report on “Capital Markets Union KPIs: Measuring progress and planning for success” Edit

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through seven Key Performance Indicators (KPIs). The report, which EBAN contributed to, is entitled, ‘Capital Markets Union Key Performance Indicators: Measuring progress and planning for success‘, and is the first publication in what will be an annual series which will regularly review developments in the CMU project and identify what further work needs to be done. {{ vc_btn:title=Download+the+Capital+Markets+Union+Report&style=flat&color=danger&align=center&link=url%3Ahttps%253A%252F%252Fwww.afme.eu%252Fportals%252F0%252Fglobalassets%252Fdownloads%252Fpublications%252Fafme-cmu-kpi-report-4.pdf%7C%7Ctarget%3A%2520_blank%7C }}

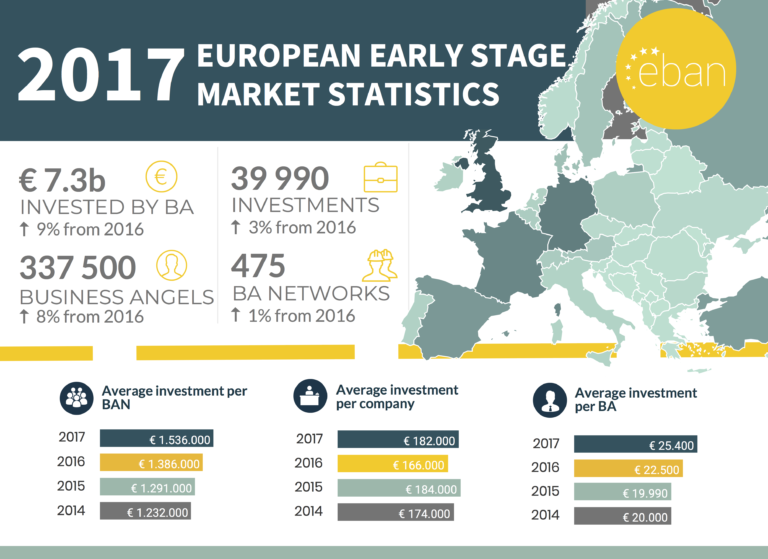

2017 Annual EBAN Statistics Compendium

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, is delighted to announce the EBAN 2017 Annual Statistics Compendium – Europe’s most extensive annual research on the activity of business angels and business angel networks. The Statistics Compendium provides information on the overall early stage market, on how business angel networks operate and insights into their investment attitudes and demography. In 2017, the early stage investment market in Europe totaled 11,4 billion euros, out of which 7,3 billion euros was invested by business angels, an increase of 9% from 2016! EBAN’s Statistics Compendium is based not only on the information provided by European business angel networks, Federations of BANs, individual business angels and other validated early stage investors who responded to EBAN’s Survey, but also based on data published in national and regional research studies on angel investment and EU Commission publications, Dealroom.co, Crunchbase, Zephyr (Bureau va Dijk) databases, governmental BA co-investment funds and fiscal incentive reports. {{ vc_btn:title=Download+EBAN%27s+2017+Statistics+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2018%252F07%252FEBAN-Statistics-Compendium-2017.pdf%7C%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+the+Statistics+Infographic&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2018%252F07%252FFinal-Infographic-2017.png%7C%7Ctarget%3A%2520_blank%7C }}

2017 EBAN Compendium of Fiscal Incentives

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players is proud to present the new edition of its much anticipated annual mapping of fiscal incentives available to business angels in Europe. This year, EBAN partnered again with BOFIDI to develop the annual publication. Fiscal incentives have an important role in stimulating the activity of business angels and early stage equity investors in start-ups. They encourage private investors to diversify their portfolio towards unquoted (primarily equity) investments in high-growth, innovative companies. This can significantly increase the pool of private individuals ready to make an equity investment in a start-up. EBAN expresses its gratitude to all contributors who provided data and information to the current research, in particular, we would like to thank BOFIDI and its network of partners. {{ vc_btn:title=Download+the+Fiscal+Incentives+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2018%252F07%252FEBAN-Compendium-of-Fiscal-Incentives-2017.pdf%7C%7Ctarget%3A%2520_blank%7C }}

Startup investment and ecosystems across Central and Eastern Europe

East-West Digital News has released a comprehensive research about startup investment and innovation across Central and Eastern Europe. The report contains a series of interviews with investors, entrepreneurs and experts, and fascinating insights about innovation ecosystems in 24 countries of the region. EBAN and CrunchBase have contributed fresh data about local business angel and VC activity. Download your free copy through this link: http://cee.ewdn.com

EBAN Report On Why Business Angels Do Not Invest

EBAN is pleased to present its latest research report focused on understanding the reasons why angel investors choose not to invest in early stage SMEs. The report, titled “Why Business Angels Do Not Invest”, is based on direct responses received from EBAN members and participants of our investor training workshops organized during the years of 2016-2017. 683 participants from 41 different countries, the vast majority of them being active angel investors, participated in a brief 8-question survey administered at the end of each workshop. In this report, you will find an aggregation of the survey results with a brief commentary explaining the main findings.

EBAN 2016 Statistics Compendium

The EBAN 2016 Statistics Compendium is Europe’s most extensive annual research on the activity of business angels and business angel networks. It provides information on the overall early stage market, on how business angel networks operate and insights into their investment attitudes and demography. In 2016, the early stage investment market in Europe totaled 9.9 billion euros, out of which 6.7 billion euros was invested by business angels, an increase of 8,2% from 2015! EBAN’s Statistics Compendium is based not only on the information provided by European business angel networks, Federations of BANs, individual business angels and other validated early stage investors who responded to EBAN’s Survey, but also based on data published in Crunchbase, Zephyr (Bureau va Dijk) database, governmental BA co-investment funds and tax breaks reports, and national and regional research studies on angel investment. This year’s edition of the Statistics Compendium also features data and information from the European Commission study “Understanding the Nature and Impact of the business angels in Funding Research and Innovation”, in which EBAN participated in as a partner organization together with Inova+, ZEW and Business Angels Europe. The Business Angels Funding study has been prepared for the European Commission, however it only reflects the views of the authors, and the Commission cannot be held responsible for any use which might be made of the information contained therein. More information on the European Union is available on the internet (http://europa.eu). {{ vc_btn:title=+Download+EBAN%27s+2016+Statistics+Compendium&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2017%252F11%252FStatistics-Compendium-2016-Final-Version.pdf%7C%7Ctarget%3A%2520_blank%7C }} {{ vc_btn:title=Download+EBAN%27s+2016+Statistics+Infographic&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2017%252F11%252FStatistics-Compendium-Infographics.png%7C%7Ctarget%3A%2520_blank%7C }}

EU Commission Study: Understanding the Nature and Impact of the business angels in Funding Research and Innovation

The investment of business angels in Research and Innovation (R&I) is a crucial complement to supporting start-up companies through national incentives to invest. It represents the most significant source of early stage equity investment in young and R&I firms, and angels invest throughout Europe. However, little is known about business angels and their investment behaviour throughout European venture capital markets. This report presents the outcome of a European Commission study aimed at filling this gap, in which EBAN participated in as a partner organization together with Inova+, ZEW and Business Angels Europe. Business Angels and their impact on firms were characterized through a survey of European business angels as well as interviews with business angels and business angel-backed firms. Moreover, extensive field research was done on the national context business angels operate in as well as policy measures aimed at supporting business angels. In what follows below, a short overview of the main findings is presented. The European Commission study “Understanding the Nature and Impact of the business angels in Funding Research and Innovation” has been prepared for the European Commission, however it only reflects the views of the authors, and the Commission cannot be held responsible for any use which might be made of the information contained therein. More information on the European Union is available on the internet (http://europa.eu). {{ vc_btn:title=Download+European+Commission+Study+on+Business+Angels+Funding&style=flat&color=danger&align=center&link=url%3Ahttp%253A%252F%252Fwww.eban.org%252Fwp-content%252Fuploads%252F2017%252F12%252FFinal-Report_Understanding-the-Nature-and-Impact-of-the-business-angels-in-Funding-Research-and-Innovation_FV_Formatted_Revised13.12.2017.pdf%7C%7Ctarget%3A%2520_blank%7C }}

2016 EBAN Compendium of Fiscal Incentives

EBAN is proud to present the new edition of its much anticipated annual mapping of fiscal incentives available to business angels in Europe in 2016. EBAN, the European Trade Association for Business Angels, Seed Funds, and other Early Stage Market Players, joined efforts with BOFIDI this year to develop its annual publication. Fiscal incentives have an important role in stimulating the activity of business angels – early stage equity investors in start-ups – by encouraging private investors to diversify their portfolio towards unquoted (primarily equity) investments in high-growth, innovative companies. This can significantly increase the pool of private individuals ready to make an equity investment in a start-up. Download the Compendium.

2016 EBAN Compendium of Co-investment Funds with Business Angels

This edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning, first of all, about different forms of collaboration between business angels and public authorities. It provides information on one of the most important incentives to stimulate and organise angel activity: angel investment funds and co-investment funds. In addition, it also aims to aid in discovering different forms of collaboration between business angels and other private players in the early-stage market. The compendium integrates a list of co-investment funds, angel funds, and some other relevant co-investment activities identified in Europe associated with detailed elaborations in the form of case studies about some of the abovementioned, including information as well on the expected market impact and challenges faced by these funds. Download the Compendium.

The Shortage of Risk Capital Report

Industry calls for more action on risk capital for Europe’s high growth firms. AFME has published a new report examining the specific challenges associated with raising risk capital for small and mid-size high-growth companies in the European Union. The report aims to inform policymakers about the challenges facing Europe’s high growth companies in obtaining crucial early stage financing. “The Shortage of Risk Capital for Europe’s High Growth Businesses” was authored by AFME with the support of 12 other European organisations representing all the different stakeholders involved in pre-IPO finance. These include the European Investment Fund (EIF), seven other European trade associations representing business angels (BAE, EBAN), venture capital (Invest Europe), accountants (Accountancy Europe) and crowdfunding (ECN), as well as stock exchanges (FESE, Deutsche Bӧrse, LSE, Euronext, Nasdaq). Simon Lewis, Chief Executive of AFME, said: “Europe’s shortage of risk capital for high-growth businesses is a pressing issue, particularly given the enduring low growth environment. Collectively, we are pleased to present this pan-European report providing data and recommendations on improving access to equity and venture debt financing for high growth companies. The industry looks forward to working with the Commission to help further the Capital Markets Union and growth agenda and boost EU companies’ competitiveness.” Olivier Guersent, Director-General at DG FISMA, said: “The European Commission welcomes this new pan-European study on the shortage of risk capital for ambitious firms seeking to expand. This is one of the core challenges that the EU’s Capital Markets Union seeks to address. The inadequate supply of risk capital has been a longstanding constraint on European firms with high growth potential. Under CMU, the Commission has tabled several initiatives to improve the functioning of these markets. However, there is no quick fix. European policy-makers need to stay focussed on this structural challenge in the years ahead. This report is very timely as the Commission prepares to refresh the CMU action plan through its mid-term review.” The report identifies the main barriers preventing the creation and growth of businesses in Europe and makes the following recommendations to address them: Fragmented start-up market Establishing a single EU framework for start-ups with standard rules across EU Member States would enable young businesses to scale-up across borders and facilitate access to 508 million customers. This could be done through the establishment of an EU expert group to focus on the revision of the various EU legal frameworks, insolvency laws and tax incentives for investors. There is already momentum for such a transformation with the recent Commission Start-up and Scale-up Initiative, including the proposal for an Insolvency Directive; Lack of awareness of risk capital benefits among businesses Improving awareness among entrepreneurs of how to gain and retain risk capital investors would reduce business failure rates. Better business structure and governance from the start would increase the chances of raising subsequent rounds of financing from professional investors. Businesses with stronger cash positions would emerge, leading to higher chances of survival; Under-developed business angel and crowdfunder capacity Unlocking business angel and crowdfunder capacity would allow them to invest in companies across the EU. Creating a single market for business angel investors by aligning best practices and ensuringconsistent tax incentives in the EU28 could be one way to provide more risk capital to Europe’sinnovative businesses. Education, training and certification of individual investors, as well as thepromotion of the role of syndicates and networks with a European reach, would also increase thenumber of crowdfunders and business angels; Insufficient business angel exit opportunities If business angels and crowdfunders are to invest more, they must have access to better exitopportunities. The development of networks and training, as well as the development of secondarymarkets for private shares at EU level would enable such access; Insufficient venture capital funding If Europe’s VC industry is to provide more funding, it needs to scale up. This could be achieved byproviding incentives for investing in VC funds, encouraging investment in the asset class andpromoting pension savings in the EU28 generally. Achieving a workable EU-level marketing passportfor VC fund managers (as part of the review of the EuVECA) and the launch of the pan-European fundof funds are good steps forward; Small venture debt market Developing the venture debt market in Europe could provide the necessary funding for VC-backedbusinesses to reach their next milestone. Venture debt can fill the gap between two VC equity rounds. Unfavourable environment for businesses to access public markets Building a favourable environment for access to capital markets would help small businesses accessthe information necessary to initiate long-term growth financing strategies. To do this, thedevelopment of SME advisory ecosystems of issuers, advisors, entrepreneurs, academics andEuropean centres of innovation is recommended; Sluggish primary equity market There is a need to tackle the decline in IPOs, which play a crucial role in Europe’s economy. Theproposed Prospectus Regulation is a great opportunity and further initiatives should be undertaken,such as supporting new categories of investors to invest in high-growth companies. The report outlines the various sources of EU financing available to Europe’s high-growth businesses, (including family and friends, accelerators, equity crowdfunding, business angels, venture capital, venture debt, public markets and public funding), but highlights that many of these are underused: Europe could invest more in risk capital: three million EU citizens hold non-real estate assets in excess of €1m – if even a small part of this were used for business angel investing, it would make a huge difference; European companies received €1.3m on average from venture capital compared to €6.4m in the US; Venture debt is underused: only 5% of VC-backed EU companies obtain venture debt financing compared to 15-20% in the US and 8-10% in the The report also includes an analysis of the main providers of risk capital for small innovative companies in Europe, showing that there is room for improvement in the European risk capital landscape: Business angels invested in half the number of businesses in Europe compared to the US. Only 12 EU Member States have tax incentives for early-stage investments; VC funds in Europe invested €4.1bn compared to

Fostering Business Angel Activities in Support of SME Growth

EBAN is proud to present the Guidebook on “Fostering Business Angel Activities in Support of SME Growth”. Written by EBAN for the European Commission as part of a series, this guidebook describes how business angel investments and co-investments can reach a critical mass across certain sectors, regions or countries. It discusses the various financial instruments policymakers and other stakeholders can implement to cultivate business angel investments, particularly the creation of co-investment funds. A provisional copy of the guidebook can be downloaded here and will soon be available from the European Commission website.

Investing in Private Companies – Insights for Business Angel Investors

This publication is the result of an agreement signed between EBAN and HBAN with the purpose of serving the organisations’ mutual goals of increasing the quantity, quality and success of angel investments in Europe, thus creating a better understanding of angel investment for potential new angel investors and entrepreneurs. This guide has been prepared to demystify investing in private companies for private investors (known as business angel investors). Investing in private companies is very different to investing in other asset classes and whilst high risk, can be rewarding and worthwhile with positive financial and non-financial outcomes. The current document is an adaptation of the original version with the same title which was initially targeted to the Irish market. The reproduction and/or adaptation of this guide by other parties is subject to approval of EBAN and HBAN.

Raising Business Angel Investment – European Booklet for Entrepreneurs

This publication is the result of an agreement signed between EBAN and HBAN with the purpose of serving the organisations’ mutual goals of increasing the quantity, quality and success of angel investments in Europe, thus creating a better understanding of angel investment for potential new angel investors and entrepreneurs. The current document is an adaptation of the original version “Raising Business Angel Investment Insights for Entrepreneurs” which was initially targeted to the Irish market. The reproduction and/ or adaptation of this guide by other parties is subject to approval of EBAN and HBAN. Executive summary This guide has been prepared to demystify the equity raising process for entrepreneurs. Raising external equity is very different to raising other types of finance. The following tips are developed further in this guide: » The relationship between investor and entrepreneur is like a marriage but one with a planned divorce; » tarting building the relationship early, ideally before you need any money; » Undertake due diligence on your potential investor and find out what is attractive to them; » Make sure that every contact with a potential investor addresses the top three investment criteria (management, exit and revenue potential) in some form; » The best exit is a trade sale for cash…it usually maximises value for all shareholders; » The revenue potential of your company must demonstrate a scalable business that is capable of producing significant returns for an investor; » The best business plans have a great executive summary – the point of an executive summary is to succinctly sell the investment opportunity, not to just describe the business; » A compelling and fully costed business plan is essential; » Be on top of, and understand, the numbers; » Founders should have ideally had made or intend to make a cash equity investment in the company, i.e. have ‘skin in the game’; » Have a realistic valuation expectation – the investor has to make an attractive return on their investment; » An equity deal is not just about the headline valuation; and » An apparently attractive high valuation can be undermined by high liquidation preference multiples. Raising external equity is rewarding and worthwhile if it accelerates the growth of your business. If an external investor is getting an attractive return then you are likely to be getting an even better return. This is a win-win.